Income Tax in Malaysia. SRP and APS offer reduced electricity rates based on time-of-use charging for EV owners.

Assessing The Impact Of Sugar Tax In Malaysia Euromonitor Com

The tax year in Malaysia runs from 1st January to 31st December.

. The Mexican Income Tax Law provides a 30 tax credit for RD expenses including investments in RD. Wef YA 2018 to YA 2022 of the value of increased exports deducted against 70 of SI. The economy of Malaysia is the third largest in Southeast Asia and the 34th largest in the world in terms of GDP.

To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions. The 2018 labour productivity of Malaysia was measured at Int55360 per worker the third highest in ASEAN. Superceded by the Tax Audit Framework 01042018 - Refer Year 2018.

Reduced Vehicle License Tax and carpool lane access. Research and development RD incentives. Accordingly Malaysia has been included in the US Department of Treasurys list of jurisdictions that are treated as having an IGA in effect with the US.

Electric Vehicles Solar and Energy Storage. Malaysia Sales Tax 2018. Malaysia and the US has signed the IGA on a Model 1 to implement FATCA on 21 July 2021.

Malaysia Service Tax 2018. Income tax at 15 on chargeable income from employment which commences on or before 31122022 with a designated company. See you later Jumpa lagi.

The list of jurisdictions can be found by clicking on the following link. Malaysia Digital Status companies will be entitled to a set of incentives rights and privileges from the Government subject to necessary approvals compliance of applicable conditions laws and regulationsWith greater flexibility and agility in our offerings Malaysia Digital Status companies can operate grow expand or invest anywhere in Malaysia. How Do I Say in Malay.

Up to 1000 state tax credit Local and Utility Incentives. US 10460 World Bank 2018 Internet domain. This incentive cannot be combined with other tax incentives.

Malaysia offers a wide range of tax incentives ranging from tax exemptions. Tax Audit Framework On Withholding Tax available in Malay version only 01082015. Tax Exemption On Rental Income From Residential Houses.

Different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. Tucson Electric Power offers a rebate of up to 300 as a bill credit for residential charger installation. Incentives to invest are focused on the High Technology.

Tax Social Security in Malaysia. Tax Audit Framework On Finance and Insurance Superceded by the Tax Audit Framework On Finance and Insurance 18112020 - Refer Year 2020. SST Treatment in Designated Area and Special Area.

Under the 2019 Tax Reform RD tax incentives the RD tax credit system were revised to promote innovation by i increasing the tax credit ratio ii increasing the limitation of tax credits for qualified venture corporations ie from 25 to 40 of the corporate tax amount and iii expanding the scope of open innovation RD activities to include the cost of B2B. Knowledge workers working in Iskandar Malaysia. According to the Global Competitiveness Report 2021 the Malaysian economy is the 25th most competitive country economy in the world.

The tax credit will be equal to current-year RD expenses in excess of the average RD expenses incurred in the previous three years.

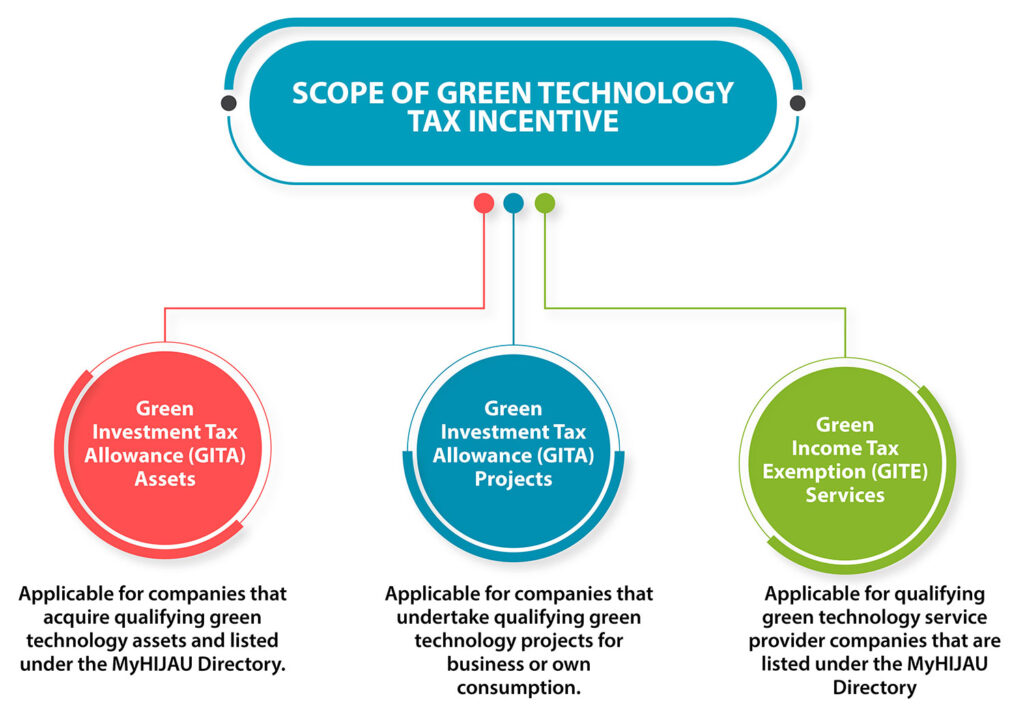

Green Investment Tax Allowance Gita Green Income Tax Exemption Gite Malaysian Green Technology And Climate Change Corporation

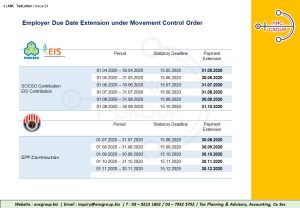

Pemerkasa Assistance Package Crowe Malaysia Plt

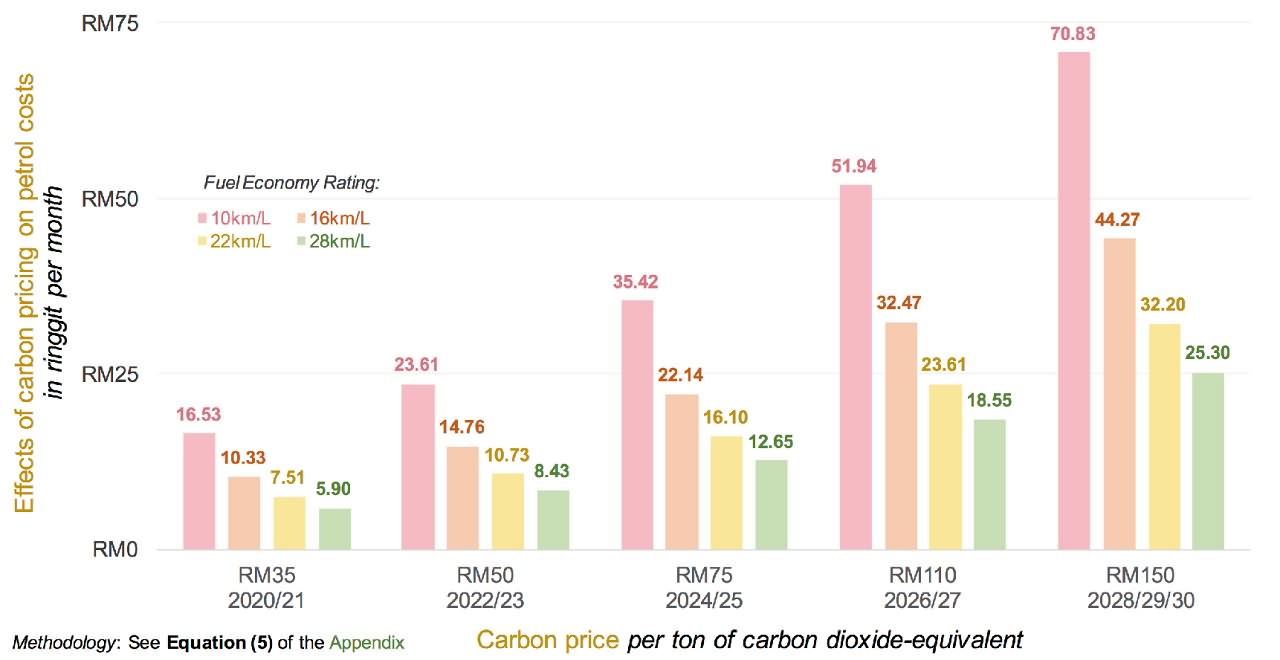

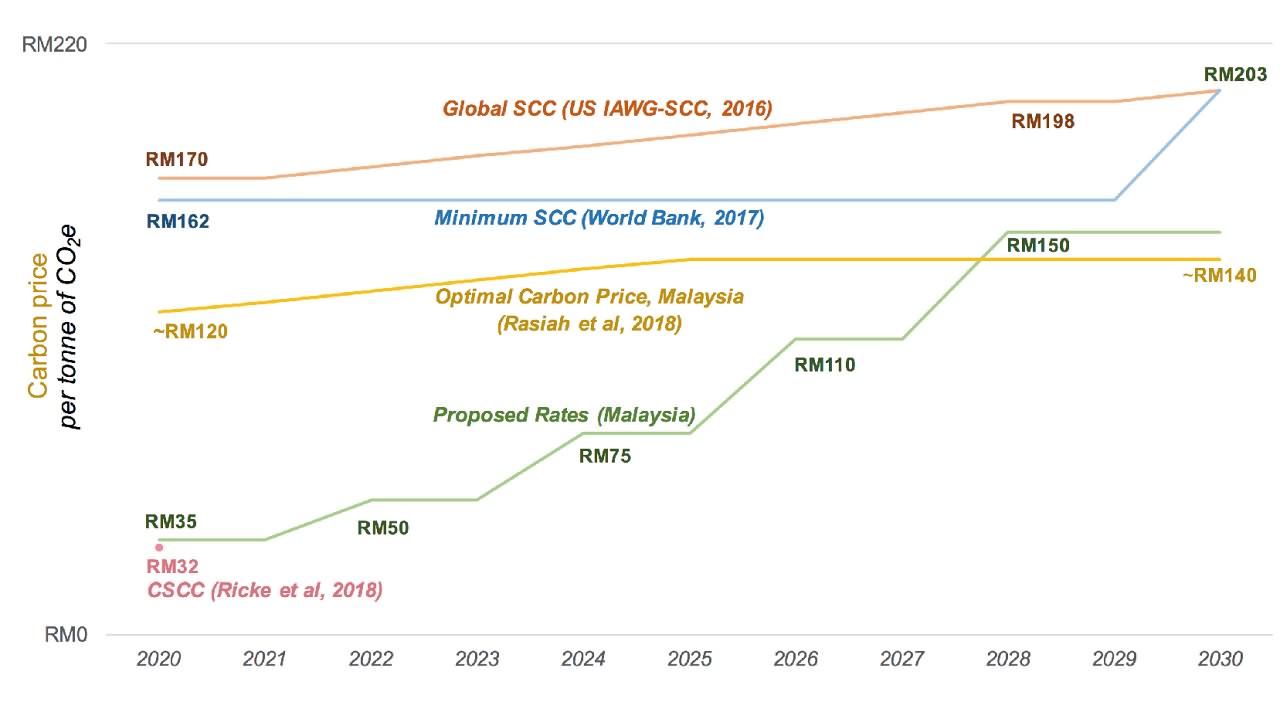

A Proposal For Carbon Price And Rebate Cpr In Malaysia Penang Institute

Malaysian Tax Issues For Expats Activpayroll

A Proposal For Carbon Price And Rebate Cpr In Malaysia Penang Institute

Assessing The Impact Of Sugar Tax In Malaysia Euromonitor Com

6 Reason To Invest In Malaysia Stock Exchange Financial Management Stock Exchange Investing

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Tax Incentives For Green Technology In Malaysia Gita Gite Project

Updated Guide On Donations And Gifts Tax Deductions

Malaysia Personal Income Tax Guide 2021 Ya 2020

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

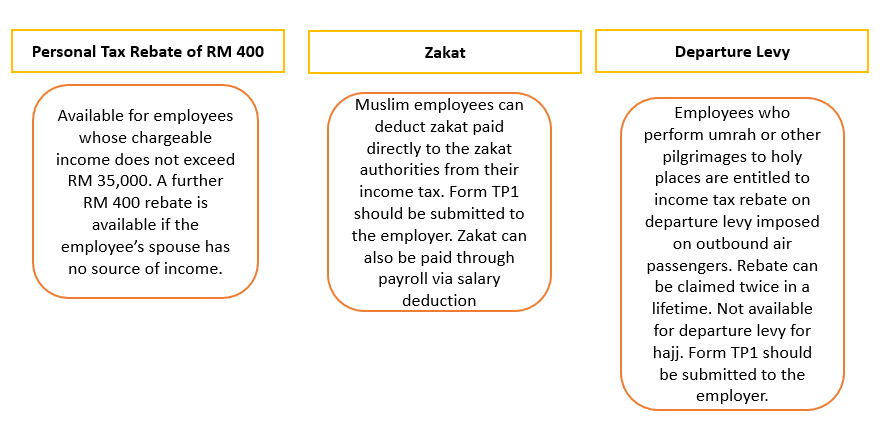

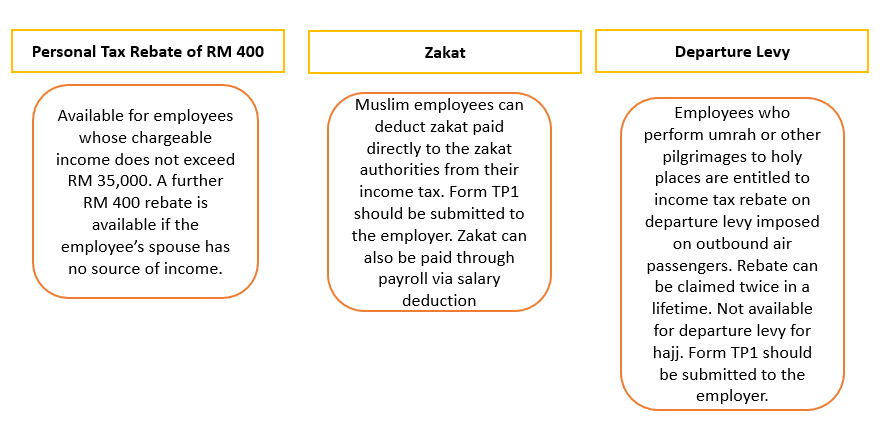

Everything You Need To Know About Running Payroll In Malaysia

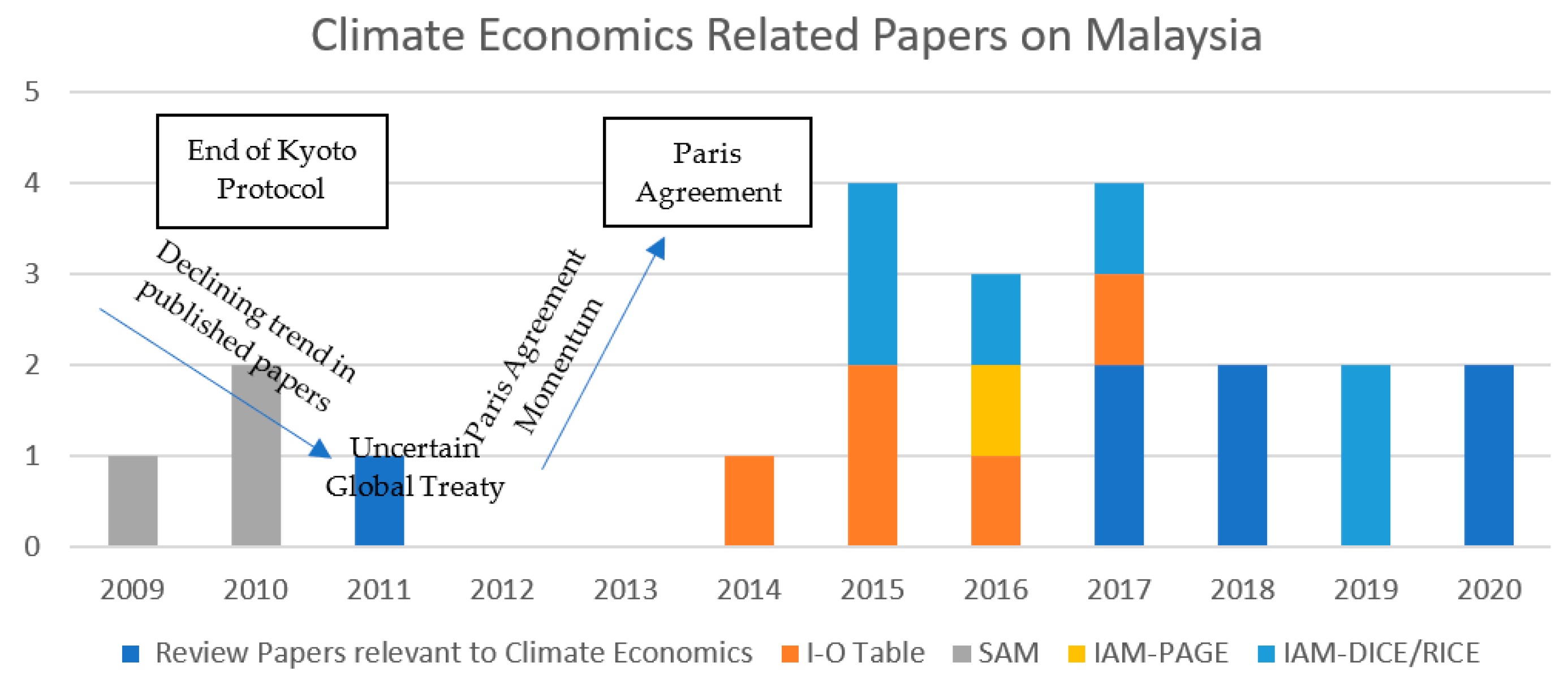

Sustainability Free Full Text A Review Of Climate Economic Models In Malaysia Html

A Proposal For Carbon Price And Rebate Cpr In Malaysia Penang Institute

19 Initiatives That Ll Benefit The Youths Under Malaysia S Budget 2022 Social Good

19 Initiatives That Ll Benefit The Youths Under Malaysia S Budget 2022 Social Good

Everything You Need To Know About Running Payroll In Malaysia